UPI Transaction Charges 2026: The Complete Bank-by-Bank Guide to Who Pays What

Remember when UPI was the completely free alternative to cards and cash? As we move through 2026, UPI processes over 25 billion transactions monthly—a scale that necessitates sustainable economics. While the core promise remains intact (P2P is forever free), a nuanced fee structure has emerged for merchant transactions. This isn’t a deterioration but a sign of maturity—ensuring banks, payment providers, and the NPCI can continue investing in security, innovation, and reliability.

This comprehensive guide cuts through the confusion, offering bank-specific insights, regulatory clarity, and practical strategies for consumers and merchants alike.

Table of Contents

Toggle1. The State of UPI in 2026: From Free Revolution to Sustainable Ecosystem

A Brief History Lesson:

2016-2020: UPI launched as a free public utility

2021-2023: Introduction of merchant-side charges, wallet interoperability

2024-2026: Refined interchange framework, credit card integration, PPI (wallet) charges

Current Reality:

P2P (Person to Person): Still 100% free—protected by RBI mandate

P2M (Person to Merchant): Merchant-side charges apply in many cases

Scale: 300+ banks live, 500 million+ active users, ₹20+ lakh crore monthly volume

Key Terminology Decoded:

Interchange Fee: Paid by merchant’s bank (acquirer) to customer’s bank (issuer)

MDR (Merchant Discount Rate): Total fee merchant pays—includes interchange + processor fee

PPI: Prepaid Payment Instruments (wallets like Paytm, Amazon Pay balance)

P2P vs P2M: Personal transfers vs business payments

2. The Core Principles: When Are UPI Charges Applied?

The Golden Rule: Sending money to friends/family via UPI ID, mobile number, or QR remains absolutely free. No charges, no limits.

Where Charges Come Into Play:

| Transaction Type | Who Pays? | Typical Charge |

|---|---|---|

| P2P Personal Transfer | No one | 0% |

| Small Merchant Payment (<₹2,000) | Merchant’s bank | 0-0.3% |

| Large Merchant Payment (>₹2,000) | Merchant’s bank | Up to 0.9% |

| PPI/Wallet via UPI Payment | Merchant’s bank → Wallet issuer | 1.1% |

| Credit Card via UPI | Merchant’s bank → Card issuer | 0.9-1.3% |

| Wallet Loading via Credit Card | Customer (as cash advance) | 1-3% + GST |

Critical Understanding: As a consumer, you’re rarely directly charged. The fees flow between banks and payment providers. However, merchants might subtly adjust pricing to account for these costs in competitive markets.

3. The “1.1% Charge” Demystified: PPI Interchange Fees

This has been the most misunderstood aspect of 2026’s UPI landscape:

What Exactly Is It?

A regulated interchange fee that applies only when you pay a merchant using your wallet balance via UPI. For example:

Paying ₹1,000 at a cafe using your Paytm Wallet balance through UPI

Using Amazon Pay balance via UPI on an e-commerce site

How It Flows:

You pay merchant ₹1,000 from your Paytm Wallet via UPI

Merchant receives ₹1,000 in their bank account

During settlement, merchant’s bank pays ₹11 (1.1%) to Paytm Payments Bank

You pay nothing extra—the deduction happens behind the scenes

Why This Matters:

Encourages direct bank account linking over wallets for large payments

Wallet companies earn revenue to sustain operations

Still cheaper than card MDR for merchants (typically 1.5-3%)

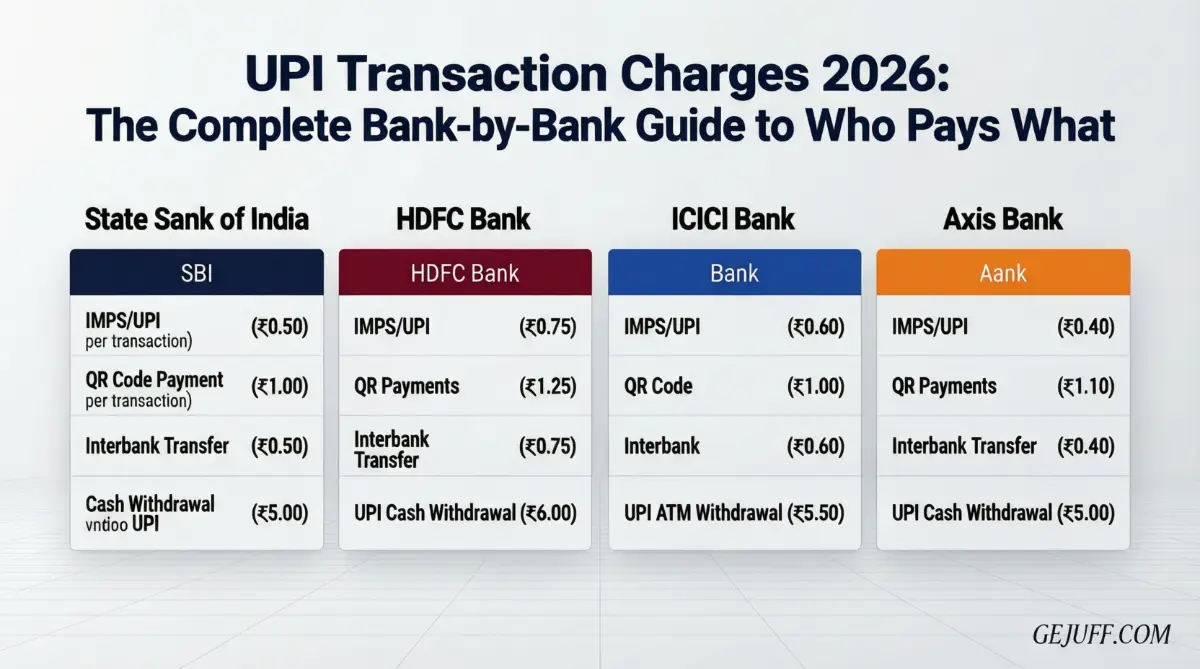

4. Bank-Wise & App-Wise UPI Charge Structure (2026 Analysis)

Public Sector Banks

| Bank & App | P2P | P2M (<₹2k) | P2M (>₹2k) | Special Notes |

|---|---|---|---|---|

| SBI (SBI Pay) | Free | 0-0.3% (merchant) | Up to 0.9% (merchant) | Free for BHIM-UPI QR at small shops |

| PNB (PNB UPI) | Free | 0-0.25% | Up to 0.85% | Lower rates for government payments |

| Bank of Baroda (MobiKwik) | Free | 0-0.3% | Up to 0.9% | Integrated with Baroda Merchant Portal |

Private Sector Banks

| Bank & App | P2P | Credit Card UPI | Wallet Loading | Special Features |

|---|---|---|---|---|

| HDFC (PayZapp) | Free | 0.9-1.1% interchange | 1% + GST if via credit card | SmartHub merchants get volume discounts |

| ICICI (iMobile Pay) | Free | 1.0-1.3% interchange | Free via debit/net banking | iMobile Pay Business: ₹500/month + 0.4% |

| Axis Bank (Axis Pay) | Free | 0.95-1.2% interchange | Credit card: 1.5% + GST | Axis ASAP for merchants: dynamic pricing |

| Kotak (Kotak UX) | Free | 0.9-1.15% | Free via Kotak accounts | Kotak Edge: premium features for fees |

Third-Party PSP Apps

| App | Consumer P2P | Merchant Rates | Wallet Charges | 2026 Positioning |

|---|---|---|---|---|

| PhonePe | Free | 0.4-1.1% based on volume | 1.1% PPI interchange | Focus on merchant solutions, insurance, wealth |

| Google Pay | Free | 0.3-0.9% for businesses | N/A (no wallet) | GPay for Business: transparent slab rates |

| Paytm | Free | 0.6-1.1% + PPI interchange | 1.1% for wallet payments | Post-2024: clear UPI-first strategy |

| Amazon Pay | Free | 0.5-1.0% for merchants | 1.1% for balance payments | Integrated with Amazon Seller services |

5. New RBI Guidelines for UPI (2025-2026): What Changed?

1. P2P Protection Clause:

“No bank or payment system provider shall levy any charge on the originator or beneficiary in a person-to-person UPI transaction.”

2. Merchant-Side Framework:

Allows reasonable interchange (0-1.1%) for P2M transactions

Mandates transparency to merchants

Prohibits passing charges directly to consumers

3. PPI Interchange Cap:

Maximum 1.1% for wallet-based UPI payments

Prevents wallet companies from excessive charging

4. Credit Card Standardization:

All RuPay credit cards must support UPI

Visa/Mastercard interoperability mandated

Interchange capped at 1.3%

5. Small Merchant Protection:

Bharat QR transactions under ₹100: zero charges

Street vendors, small shops: subsidized rates

6. Detailed Scenarios: Am I Being Charged? (Real Examples)

Scenario 1: Grocery Shopping

You pay ₹2,500 at Reliance Fresh via UPI from ICICI bank account

Your cost: ₹0

Behind scenes: Reliance’s bank pays ~₹22.50 (0.9%) to ICICI Bank

Verdict: NOT CHARGED

Scenario 2: Paying Friend for Tickets

You send ₹800 to your friend via PhonePe

Your cost: ₹0

Behind scenes: No money moves between banks (just ledger updates)

Verdict: COMPLETELY FREE

Scenario 3: Fuel Station with Wallet

You pay ₹3,000 for fuel using Paytm Wallet via UPI

Your cost: ₹0

Behind scenes: Fuel station’s bank pays ₹33 (1.1%) to Paytm

Verdict: NOT DIRECTLY CHARGED (but merchant pays)

Scenario 4: Credit Card via UPI for Electronics

You buy ₹50,000 iPhone using HDFC credit card via UPI

Your cost: ₹0 (plus reward points!)

Behind scenes: Merchant pays ~₹500 (1%) interchange

Verdict: NOT CHARGED, GET REWARDS

Scenario 5: Loading Wallet via Credit Card

You add ₹10,000 to Paytm using Axis credit card via UPI

Your cost: ₹150-300 (1.5-3% cash advance fee + GST)

Verdict: DIRECTLY CHARGED (avoid this!)

7. How to Avoid or Minimize UPI Charges: Smart Tips for 2026

For Consumers:

Always use direct bank account for large merchant payments (>₹2,000)

Avoid wallet-based UPI for significant purchases—use bank UPI instead

Never load wallets with credit cards via UPI (cash advance fees apply)

Split large payments if merchants complain about charges (but only if convenient)

Use Bharat QR codes at small shops—often zero MDR

Check credit card terms before linking to UPI

Prefer your bank’s UPI app for potentially better security and support

For Merchants/Small Businesses:

Choose static Bharat QR over dynamic QR for lowest MDR

Negotiate with payment providers based on monthly volume

Consider flat-fee SaaS models if transaction volume is high

Pass on savings to customers paying via low-MDR methods

Use UPI for recurring payments—often cheaper than card auto-debit

For Freelancers/Professionals:

Invoice as “personal” payments when appropriate (but be ethical)

Use UPI for client advances—free and instant

Consider business UPI apps for tracking and analytics

Educate clients about UPI’s cost benefits over corporate wire transfers

8. Is UPI Still Viable? The 2026 Reality Check

Absolutely—and here’s why:

| Parameter | UPI | Debit Cards | Credit Cards | Cash |

|---|---|---|---|---|

| Consumer Cost | Free (P2P), Free (P2M) | Free | Free (if paid monthly) | Transportation, risk |

| Merchant Cost | 0-1.1% | 0.4-1.0% | 1.5-3.0% | 2-4% (handling) |

| Settlement | Instant-24 hours | 2-3 days | 3-5 days | Instant |

| Convenience | Highest (no card needed) | Medium | Medium | Low (change issues) |

The Sustainability Equation:

NPCI’s cost: ~₹0.50 per transaction (infrastructure, security, innovation)

Bank’s cost: Customer support, fraud prevention, app development

Revenue needed: ₹10,000+ crore annually at current volumes

Solution: Minimal merchant-side charges enable continued investment

9. The Future Outlook: What’s Next for UPI Fees?

2027-2030 Projections:

Tiered Consumer Accounts:

Basic UPI: Free with ₹1 lakh/month limit

UPI Plus: ₹29/month for ₹5 lakh limit, insurance, premium support

UPI Pro: ₹99/month for ₹25 lakh limit, international payments, analytics

Sector-Specific Rates:

Healthcare/Education: 0-0.3% (subsidized)

Luxury/Entertainment: 1-1.5%

Government: Zero MDR continues

International Expansion:

UPI-PayNow (Singapore): 0.5-1% forex + processing

UPI in UAE/US: Similar cross-border charges

NPCI Global Cards: RuPay-UPI integration worldwide

Value-Added Services:

UPI with insurance: 0.1% extra for transaction insurance

Credit on UPI: Instant loans at point of sale

Investment via UPI: Direct mutual fund/stock purchases

Regulatory Evolution:

Possible consumer-side charges for >₹5 lakh/month usage

Environmental fees for excessive transactions (unlikely but discussed)

Mandatory security deposits for large-value UPI

10. Frequently Asked Questions (FAQs)

Q1: Is UPI really free in 2026?

A: For sending to individuals—100% free. For paying merchants, you don’t pay directly but merchants might pay small fees to their banks.

Q2: I’m seeing “processing fee” on some UPI transactions—is this allowed?

A: No legitimate UPI payment to another person should show any fee. If you see this, it’s likely a scam or a merchant masquerading as P2P. Report it immediately.

Q3: Which is better—bank UPI app or PhonePe/Google Pay?

A: For security: bank apps. For features: third-party apps. For cost: identical (all free for P2P).

Q4: Should I stop using Paytm Wallet after the 1.1% charge?

A: Not necessarily—still convenient for small payments. But for purchases over ₹1,000, use direct bank UPI.

Q5: How do I know if a merchant is paying charges?

A: You don’t—and shouldn’t need to. Their agreement with their bank is their concern. Your price should be the same regardless of payment method.

Q6: Are UPI charges tax deductible for businesses?

A: Yes, MDR/processing fees are business expenses deductible under the Income Tax Act.

Q7: What happens if I accidentally pay a merchant as “personal”?

A: The payment goes through but the merchant might not get automated reconciliation. They can still accept it manually.

Q8: Is there a monthly limit on free UPI transactions?

A: Most banks have ₹1-5 lakh daily limits, but no monthly transaction limits for P2P.

Q9: Can charges be applied retroactively?

A: No. Any new charges must be communicated 30 days in advance.

Q10: Will UPI remain free for seniors/students?

A: Currently no special categories, but likely future subsidy programs for vulnerable groups.

Disclaimer: Charges and policies are subject to change. This guide reflects the 2026 landscape based on RBI circulars, NPCI guidelines, and bank tariff sheets available as of January 2026. Always check your bank’s latest schedule of charges for the most current information

#UPICharges2026 #UPIFees #UPIIndia #DigitalPayments #RBIguidelines #UPIguide #BankCharges #PhonePe #GooglePay #Paytm #UPItransaction #PPIcharge #MerchantFees #UPIforBusiness #AvoidUPIcharges #BharatQR #UPIapps #UPIcreditcard #Walletcharges #NPCI #UPInews2026

Check More- Daily 100 Rupees Earning App Without Investment 2026

Post Comment